Investing in commercial real estate can be an excellent opportunity to build wealth.

As with all investments, profit potential is your main consideration when comparing different properties. How can you be confident that the money you invest today will generate a healthy return in the future?

That’s where net present value and internal rate of return come in. These metrics give you an estimate of whether a potential investment will generate a profit or loss. They also consider the present value of your investment in today’s dollars.

- Net present value – or NPV – is the difference between the present value of expected cash inflows and the present value of cash outlays over a defined period of time. It is expressed as a dollar amount.

- Internal rate of return – also known as IRR – is the estimated annual growth rate. It is expressed as a percentage.

Let’s take a closer look at how to use these metrics when assessing and comparing commercial real estate opportunities.

Net Present Value

Net present value considers all expected cash flows over the life of an investment.

- NPV equals the difference between cash inflows and cash outflows.

- An NPV greater than zero generally indicates a profitable investment.

- A negative NPV means the investment is more likely to lose value.

Factors to consider when estimating NPV include anticipated inflation and reinvestment rates.

How to calculate Net Present Value

To determine the NPV, follow these steps:

- Estimate your likely cash flows, using a discount rate to estimate present value.

- Subtract estimated cash inflow from your initial cash outlay.

- The difference is the net present value of the investment.

Cash flows will vary over time for many investments. For example, inflows may be greater in some years than in others.

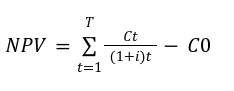

Analysts use the following formula to estimate the timing and amount of expected cash flows across the life of the investment.

Net Value Present Formula:

Ct = Net cash inflow during period t

C0 = Total initial investment cost

i = Discount rate

t = Number of time periods

Analysts use a discount rate that is equal to the minimum acceptable rate of return. It is based on the principle that inflation erodes the value of money over time, so that a dollar today is worth more than a dollar tomorrow. A positive NPV generally indicates that the rate of return is likely to be greater than the discount rate.

Internal Rate of Return

The internal rate of return is useful for comparing multiple investments on a fair basis. This is helpful if you are considering more than one commercial property. IRR estimates the annual rate of growth a property is expected to generate. The higher the number, the greater your earnings potential.

One common question is how IRR is different from return on investment, or ROI. The key difference is that ROI calculates the percentage increase or decrease in value for the investment as a whole. IRR, on the other hand, considers the variation in cash flow across individual time periods, along with the present value of future dollars.

How to calculate Internal Rate of Return

Mathematically, IRR is the discount rate at which the net present value of cash inflows is equal to your initial investment.

To determine IRR, use the following steps:

- Apply the same formula as you would to calculate the net present value.

- Set the NPV to zero.

- Solve for the discount rate.

If the IRR is greater than the expected discount rate, the investment is more likely to be profitable. If it is less than the discount rate, the property is less likely to earn a profit.

Special Considerations for Using NPV & IRR

Although NPV and IRR give you helpful information for assessing commercial properties, there are some caveats to keep in mind.

For starters, future cash flows are difficult to predict. As we’ve all seen in recent years, market conditions may change in response to unexpected events. Many analysts will calculate more than one estimate reflecting a range of possible scenarios, from conservative to optimistic.

The rate of return for most investments will vary from year to year, even during times of relative market stability. You can expect that the actual performance of a commercial property will differ somewhat from the NPV and IRR calculated.

It’s always essential to look at multiple factors when making investment decisions. Examples include up-front expenses and investment duration. You’ll also want to consider the level of risk and time commitment you’re prepared to take on.

Most analysts use specialized software to calculate NPV and IRR for you, so you won’t be expected to work the equation by hand.

Choosing an experienced commercial real estate broker will help you sort through all of the information you need to make a wise investment decision. With over 60 years of combined experience, Commercial One Brokers has the in-depth knowledge to provide the best service possible.

We invite you to contact us today to learn more about the exciting opportunities available in the Branson, Missouri area.